Loan Charge – Government Review

Groups who have been campaigning for the 2019 Loan Charge to be scrapped won a small victory last week. They secured an amendment to the Finance Bill which forces the government to review the loan charge legislation by 30 March 2019.

This does not remove or alter the loan charge, which comes into effect to on 5 April 2019, as the law was passed in 2017, with supplementary charges added in 2018. However, the requirement for a review, particularly of the apparently retrospective nature of the charge, has been welcomed by the professional bodies and contractor groups.

HMRC has estimated that around 50,000 people may have used loan schemes managed by offshore ‘umbrella’ companies. However, only around 25,500 individuals have come forward to agree a repayment schedule of the tax due.

The remaining taxpayers in that group will be subject to the loan charge from 5 April 2019 if they have not agreed a settlement with HMRC by that date. Those taxpayers do not have to pay all the tax due by 5 April 2019, but they must have an agreement in place to pay.

Where the taxpayer’s current annual income less than £50,000 and they are no longer using loan scheme or any tax avoidance arrangement, HMRC will offer a five-year instalment arrangement to pay the outstanding tax, on a ‘no questions asked’ basis. If the taxpayer needs longer than five years to pay, HMRC will consider the case on an individual basis.

Where HMRC accept an instalment arrangement, they will charge ‘forward interest’ – which is the normal interest rate plus 1%, with effect from 6 April 2019. The estimated forward interest, based on the progressively reducing balance after each instalment, will be included in the settlement amount.

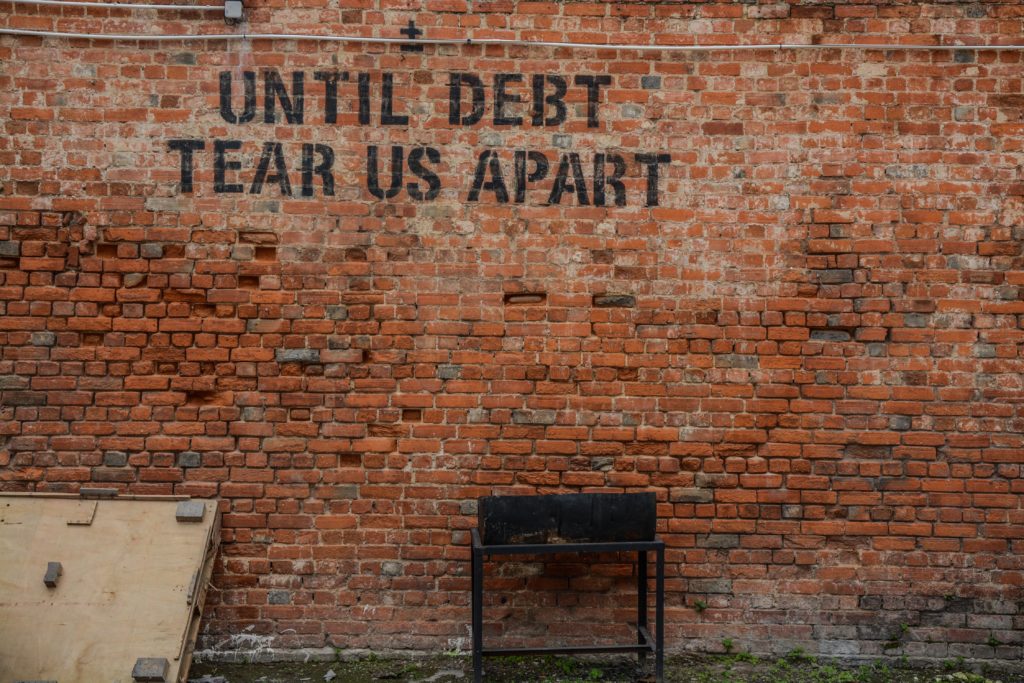

It is imperative that the taxpayer makes the promised payments under the settlement in full and on time. If they default on the instalment arrangement made, the debt will be passed to HMRC’s Debt Management team, who are more rottweiler than pussycat – possibly not like this though!

HMRC originally set a deadline of 30 September 2018 for people to agree a settlement for loan charge liabilities, but they will still work with agents and taxpayers to come to an agreement even at this late stage.